3879 the annual statewide cap would be 50 million for metropolitan counties and 50 million for nonmetro counties. The New Markets Tax Credit Coalition July 1 released the 2020 NMTC Progress Report a survey of 65 CDEs.

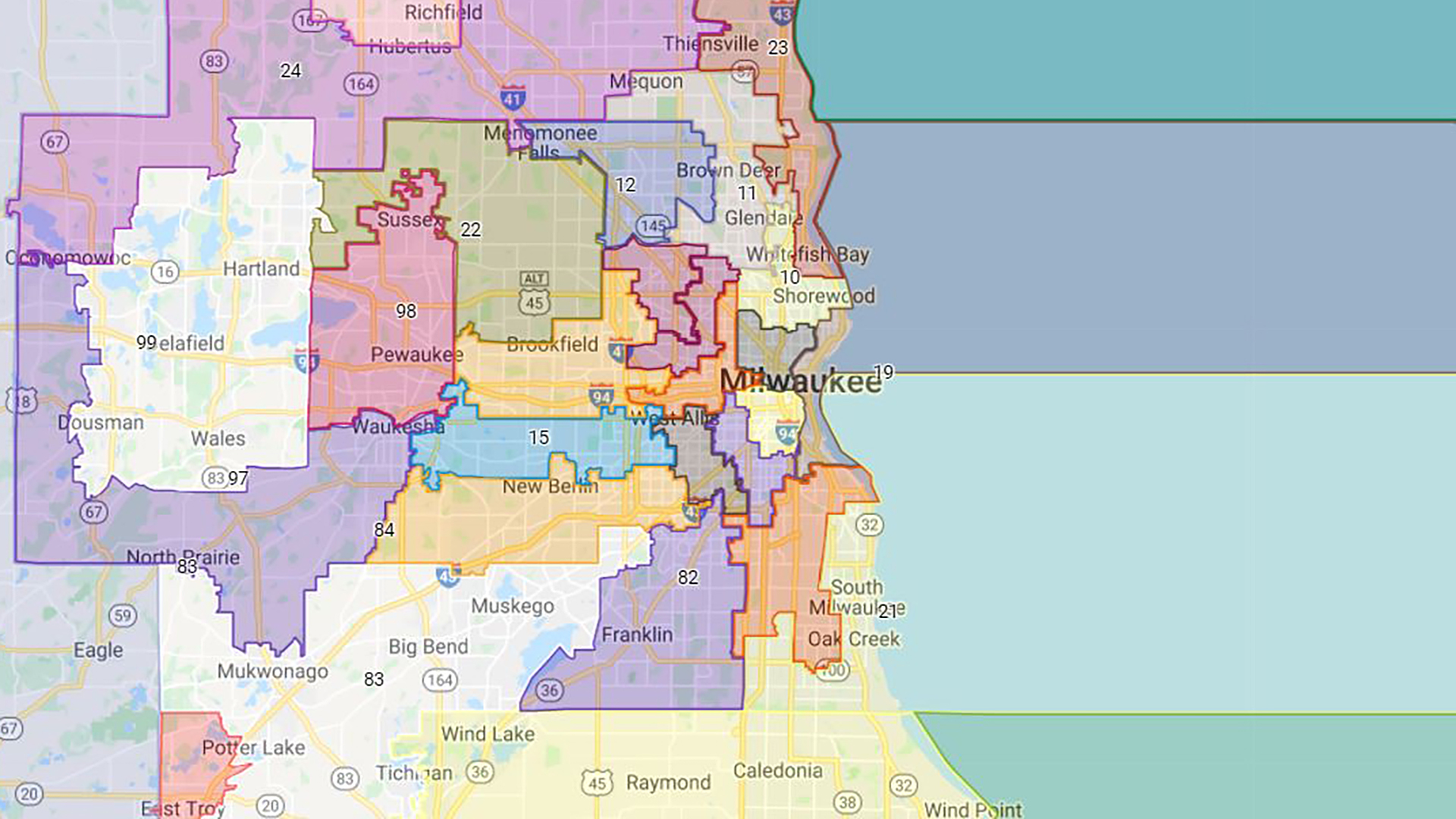

Welcome To The Cdfi Fund Cims Mapping Tool Community Development Financial Institutions Fund

From 2003 through 2020 the program has parceled out credits worth 26 billion in 2020 dollars.

. The federal New Markets Tax Credit is designed to provide financing for economic development activities within low-income communities at the census tract level with median household incomes of no more than 80 or a poverty rate of over 20. Department of the Treasurys Community Development Financial Institutions Fund CDFI Fund announced 5 billion in New Markets Tax Credits today that will spur investment and economic growth in low-income urban and rural communities nationwide. Located in a low-income community.

To change the time frame to 2006-2010 click on Edit Data in the legend and adjust the time frame there. 2020 Center for Food Education. NMTCs are a significant tool to help overcome such barriers and attract private investments in community and economic.

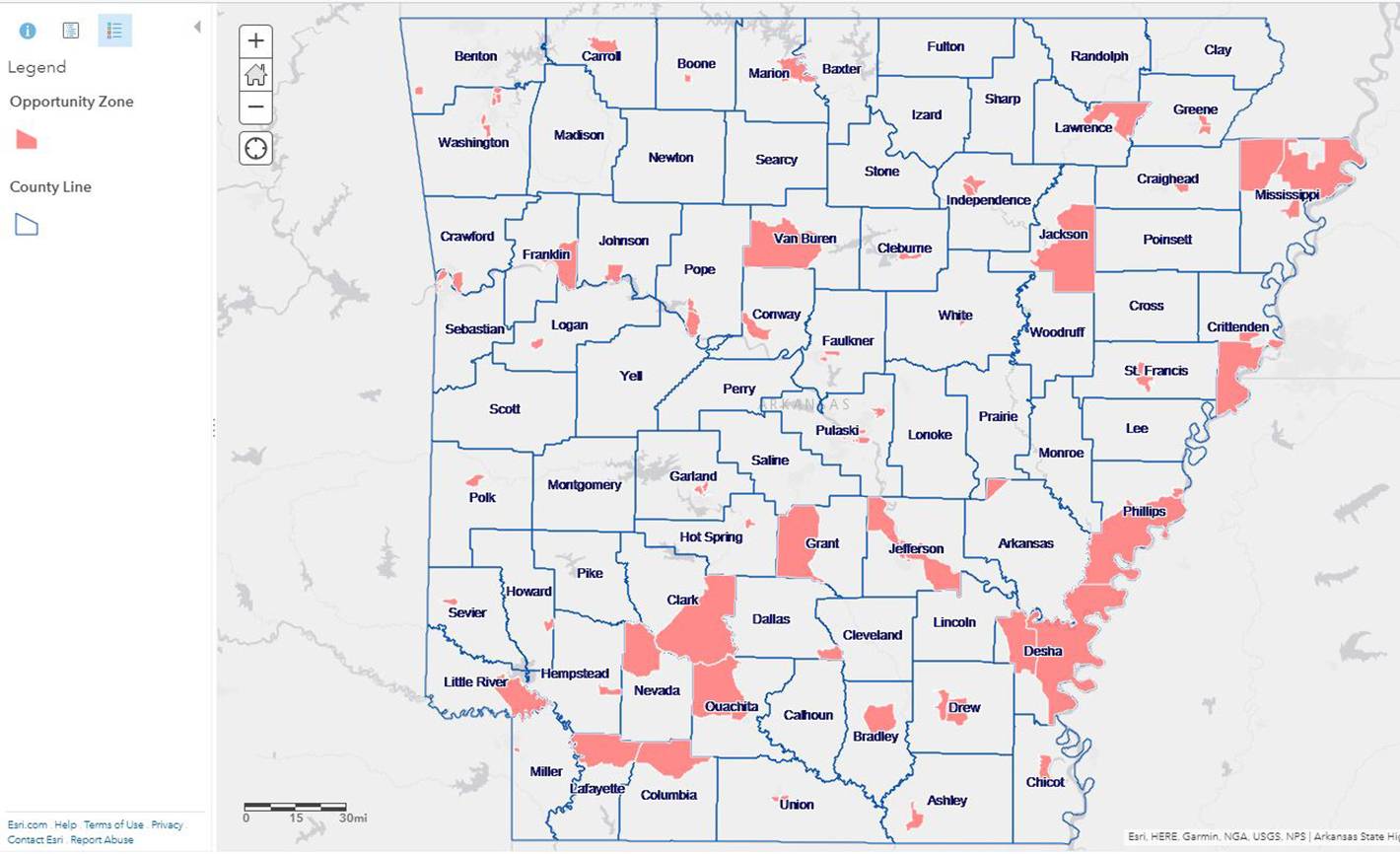

Congress established the New Markets Tax Credit NMTC Program in 2000 to permit individual and corporate taxpayers to receive a credit. When a user clicks on the map the info bubble displays values based on the 2011-2015 eligibility data. Your project may be eligible for the Program based on its location in a qualified census tract.

The New Markets Tax Credit Coalition 1155 15th Street NW Suite 400 Washington DC 20005 202-393-5225. Total credit equals 39 of the original amount invested in the CDE. As of the end of FY 2020 the NMTC Program has.

Rural officials businesses community based organizations and residents face overwhelming challenges to solving the extraordinary socio-economic barriers that impede achieving a healthy quality of life and prosperity. CDEs use their authority to offer tax credits to investors in exchange for equity in the CDE. A total of 100 Community Development Entities CDEs were awarded tax credit.

New Markets Tax Credits NMTC mapping tool May 19 2020 Use the interactive tax credit mapping tool Look at every opportunity to finance projects by evaluating their eligibility for tax credit financing through the NMTC program which is designed to support investment in low-income communities. The credit rate is. The New Markets Tax Credit Coalition 1155 15th Street NW Suite 400 Washington DC 20005 202-393-5225.

The data that displays will then be 2006-2010 as will the data in the info bubble. The New Markets Tax Credit Coalition 1155 15th Street NW Suite 400 Washington DC 20005. Over the last 15 years the NMTC has proven to be an effective targeted and cost-efficient financing tool valued by businesses communities and investors.

First it costs around 23500 in NMTC-subsidized investment to raise a person in a community near the median family income threshold out of poverty. The New Markets Tax Credit NMTC was designed to increase the flow of capital to businesses and low income communities by providing a modest tax incentive to private investors. 95091 the department shall direct the Department of Revenue at any time before Dec.

Old National CDE Corporation. The NMTC Program incentivizes community development and economic growth through the use of tax credits that attract private investment to distressed communities. Either census database may be used to evaluate eligibility through a transition period ending October 31 2018.

Manner of Claiming the New Markets Tax Credit. This mapping tool helps access eligibility using census-based criteria from the 2011-2015 and 2006-2010 American Community Surveys. The CDEs reported using 27 billion in NMTC allocation in 2019 to finance 288 investments that amounted to 45 billion in project investment to low-income communities and 17 million people served.

Congress authorizes the amount of credit which the Treasury then allocates to qualified applicants. 6 of the original investment amount in each of the final four years. The NMTC has supported more than 5300 projects in all 50 states the District of Columbia.

The NMTC allocation for the 2020 round is set at 5 billion in tax credit allocation authorityan increase of 15 billion over the 35 billion allocated in NMTCs initially authorized for 2019. The federal government recaptures any portion of the federal NMTC. The New Markets Tax Credit NMTC was established in 2000.

The New Markets Tax Credit is taken over a 7-year period. Low Income Investment Fund. Seven-year credit period for every dollar invested and designated as a QEI.

The IRS in Notice 2020-49 postponed until December 31 2020 the due dates for making investments and reinvestments and expending amounts for construction of real property under the new markets tax credit IRC Section 45D. Legislation introduced in the Minnesota Senate this week would create a state new markets tax credit NMTC incentive worth 50 of qualified equity investments QEI up to double the QEI authority for the federal NMTC. Awards will Spur Economic and Community Development Nationwide WASHINGTON The US.

The CDFI fund provided the allocation availability notice PDF 209 KB which is scheduled to be published in the Federal Register on September 23 2020. The new 2011-2015 data is displayed by default. In contrast with the Earned Income Tax Credit EITC an anti-poverty tax credit that subsidizes work among.

11 rows 2020. Generated 8 of private investment for every 1 of federal funding. The federal tax credit also designates a severely distressed area.

5 of the original investment amount in each of the first three years. Using the capital from these equity investments CDEs can make loans and investments to businesses operating in low-income communities on better rates and terms and more flexible features than the market. Department of the Treasurys Community Development Financial Institutions Fund CDFI Fund announced 5 billion in New Markets Tax Credits today that will spur investment and economic growth in low-income urban and rural communities nationwide.

New Markets Tax Credit Low-Income Community Census Tracts - American Community Survey 2011-2015 November 2 2017New Markets Tax Credit 2011-2015 American Community Survey Census Transition FAQs October 30 2017During the one-year transition period both sets of data will be available in in the NMTC Mapping ToolThe new 2011-2015 data is displayed by default. 31 2022 to recapture all or a portion of a tax credit authorized pursuant to the New Markets Development Program Act if one or more of the following occur. New Markets Tax Credit Benefits.

It also costs an average of more than 53000 in NMTC investment to generate a job. A taxpayer may claim the NMTC for each applicable year by completing Form 8874 New Markets Credit and filing the form with the taxpayers federal income tax return.

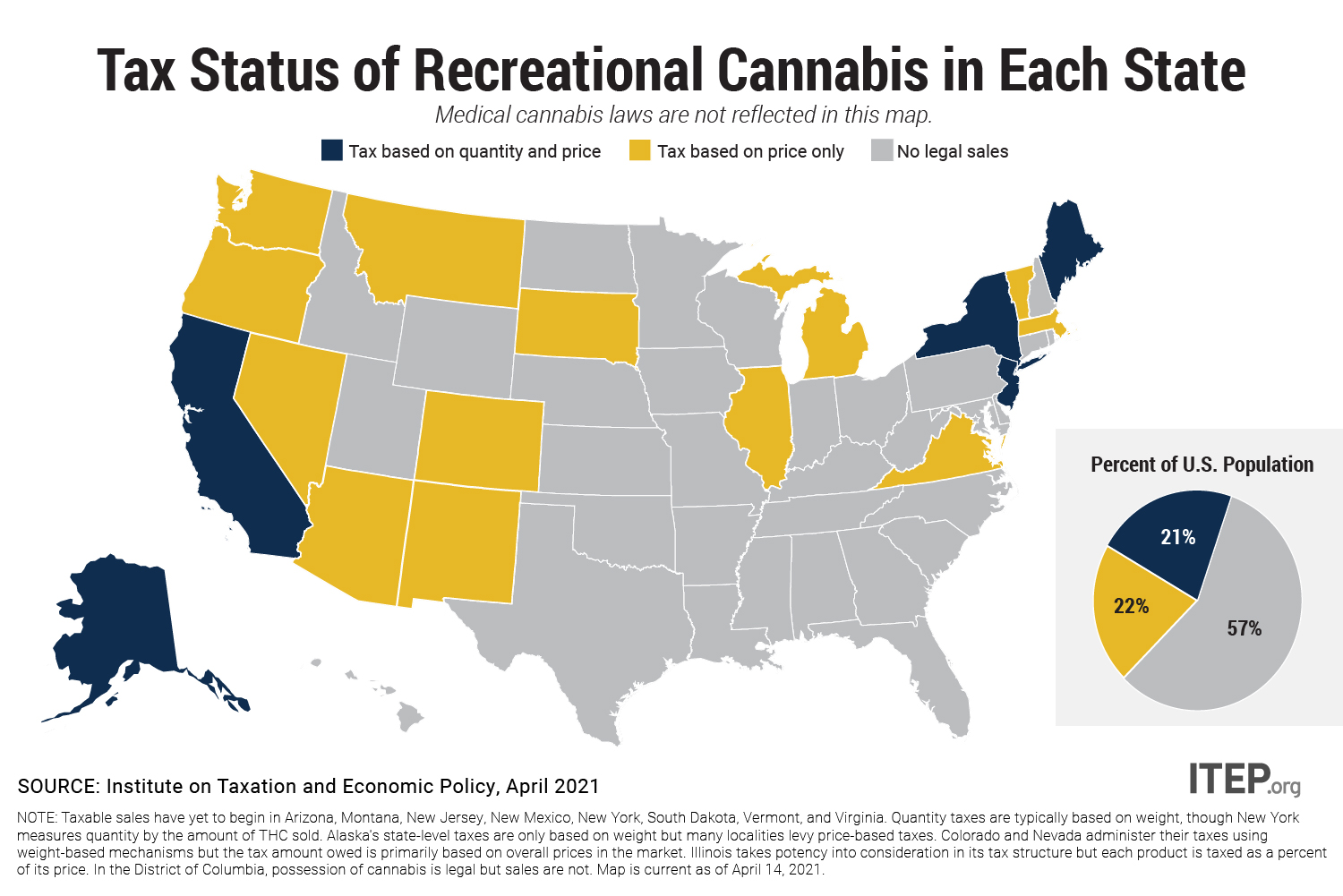

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Corporate Retention Recruitment Business Utah Gov

New Markets Tax Credit Investments In Our Nation S Communities

Manufacturing The Future Of Clean Energy With 48c Third Way

New Jersey Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

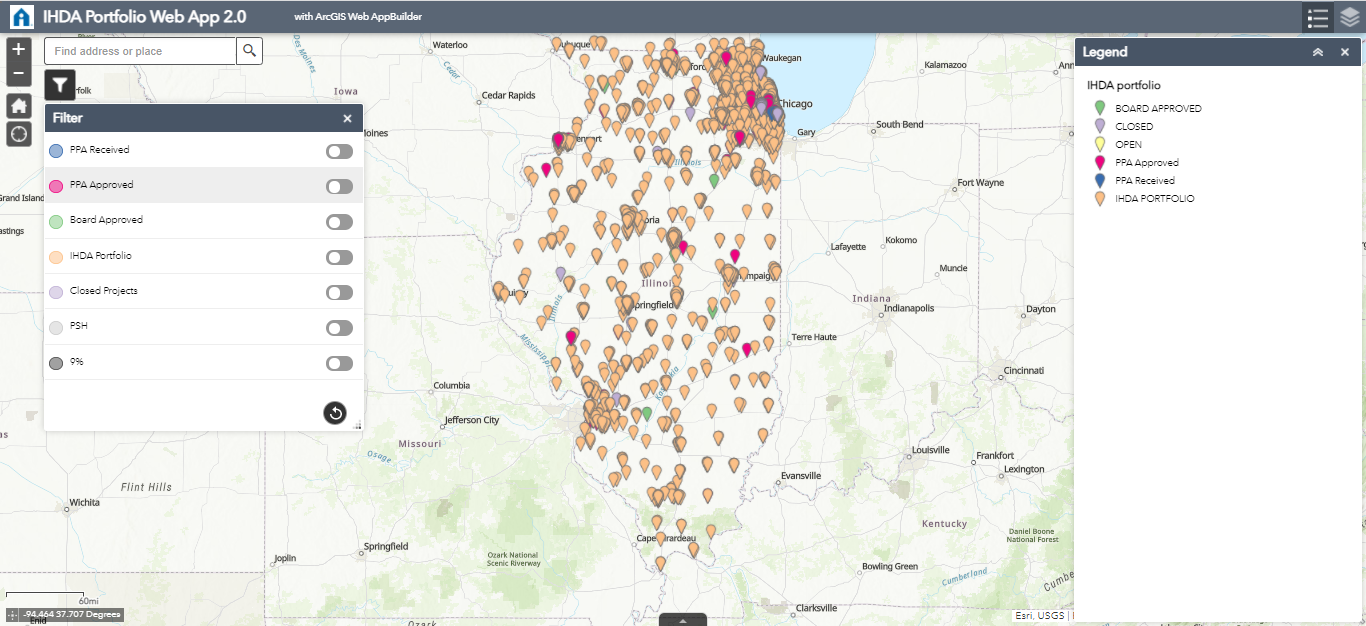

Low Income Housing Tax Credit Ihda

New Markets Tax Credit Investments In Our Nation S Communities

Us Supreme Court Upholds Wisconsin S Congressional Redistricting Rejects Legislative Maps

Nmtc Allocatee Awards Community Development Financial Institutions Fund

Low Income Housing Tax Credit Ihda

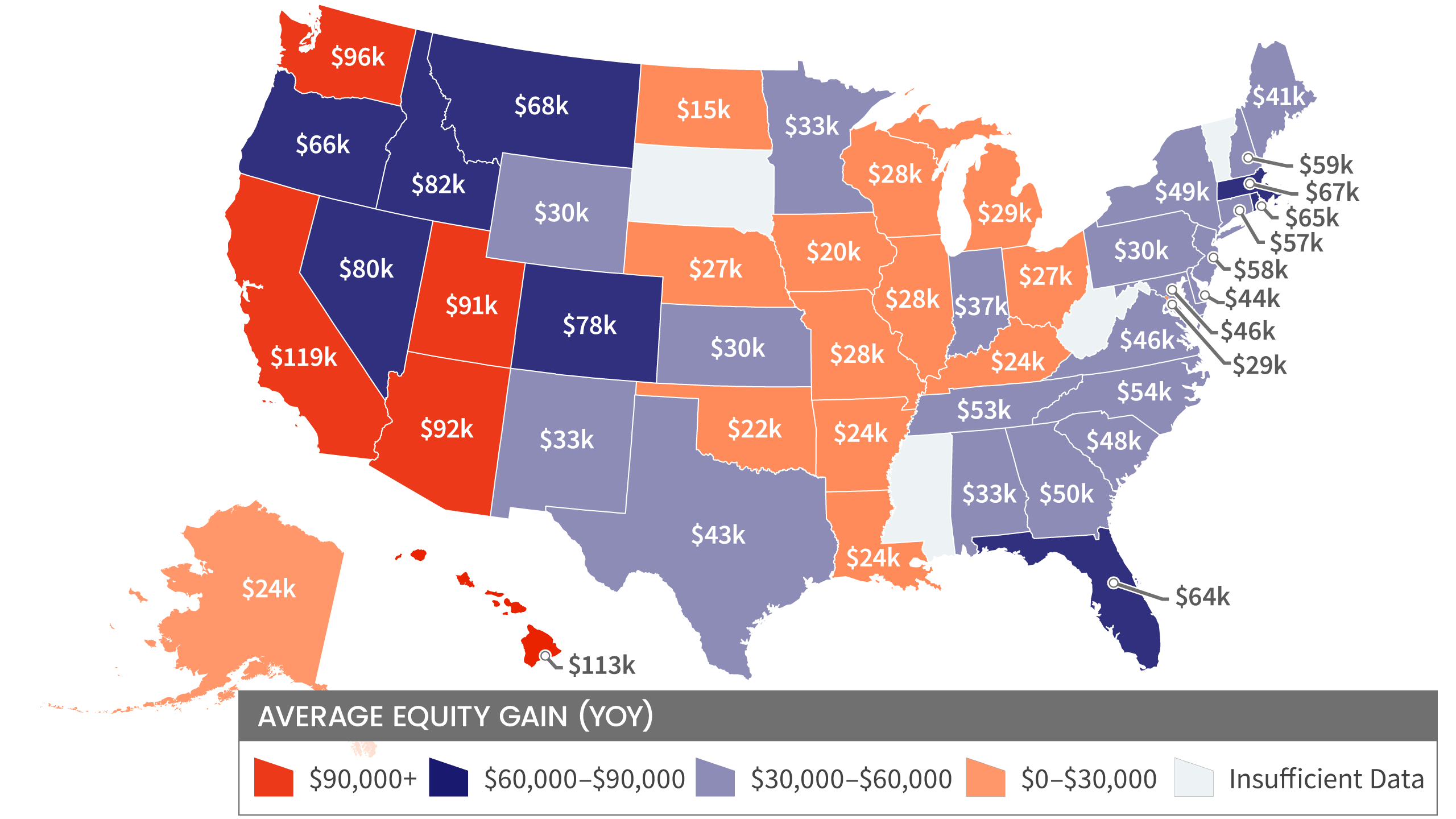

Homeowner Equity Insights Corelogic

New Markets Tax Credit Investments In Our Nation S Communities

Amazon Com United States Topographic Wall Map By Raven Maps Laminated Print Topographic Usa Wall Map Posters Prints